Our Process

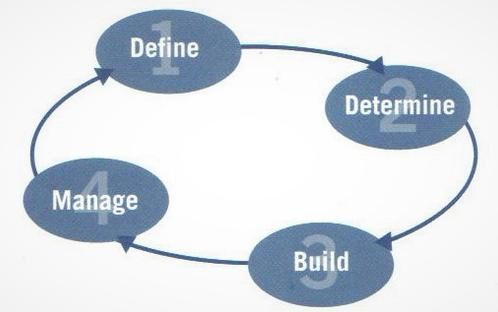

At Chamberlin Asset Management we leverage an extensive consultative process that focuses on understanding and meeting your needs. This goal-oriented process follows a comprehensive, four step approach.

The 4 Step Process

Step 1: Define Your Goals & Objectives

Step 2: Determine Your Investment Strategy

Step 2: Determine Your Investment Strategy

Together, we will work to determine your customized portfolio taking into consideration the following:

- Investment goals

- Risk tolerance

- Time horizon

- Performance expectations

- Income needs

- Liquidity requirements

- Tax considerations

- Current investments

- Special circumstances

Step 2: Determine Your Investment Strategy

Step 2: Determine Your Investment Strategy

Step 2: Determine Your Investment Strategy

Accessing the expertise of world-class research strategists and cutting edge technology we will identify the most appropriate investment options, applying the concepts of:

- Asset allocation

- Diversification

- Risk/reward characteristics of asset classes

- Correlation between asset classes

- Economic global forecasting

Step 3: Build Your Portfolio

Step 4: Manage & Monitor Your Portfolio

Step 4: Manage & Monitor Your Portfolio

Next, we will begin building a portfolio of investment vehicles designed to meet your specific needs. Security selection includes:

- Individual stocks and bonds

- ETFs

- Managed futures

- Hedge funds

- Oil and gas partnerships

- UITs

- Access to over 5,000 well-known mutual funds

Step 4: Manage & Monitor Your Portfolio

Step 4: Manage & Monitor Your Portfolio

Step 4: Manage & Monitor Your Portfolio

Once your investments are in place, the process of monitoring and managing your portfolio begins. This includes:

- Regular discussions and meetings

- Active ongoing portfolio reviews

- Periodic re-examination of your investment strategy

- Re-balancing decisions

- Weekly reports

- Surveillance of fund managers

Copyright © 2023 Chamberlin Asset Management - All Rights Reserved.

Powered by GoDaddy Website Builder